Reversing globalisation flows

Peak in Int'l equity allocations, rise in home bias, national security imperatives

Globalisation in financial markets

From the late 90s began a capital outflow story powered by the fall of communism, the addition of emerging markets as an asset class, and faith in diversification as portfolio theory. Predicting cross-border capital flows became as much a part of global macro as forecasting growth & inflation.

Powerful cross-border flows could overwhelm domestic valuation arguments, dilute monetary policy transmission, and often wreak havoc on EM capital accounts. It was this trend, in fact, that led me to develop a global risk appetite framework in 1998 to guide my thematic investment process. Using this framework, our Fund was able to successfully predict many market trends where traders and Authorities were struggling to explain long-term deviations from fair-value in currency markets.

Rising risk appetite in the major markets (primarily the US), driven by favourable domestic financial conditions, would lead to increased opportunistic allocations to international assets, taking on both the asset class and currency risk. Exposures to int’l in the 90s were low, and diversification was part of the incentive, so local valuations in overseas markets (including currency) were less of a concern. No where was this more true than in Asia where I was based from 1985-2003. This trend eventually became synonymous with globalisation. Globalisation in financial markets was always an early and constant frontier-pushing trend.

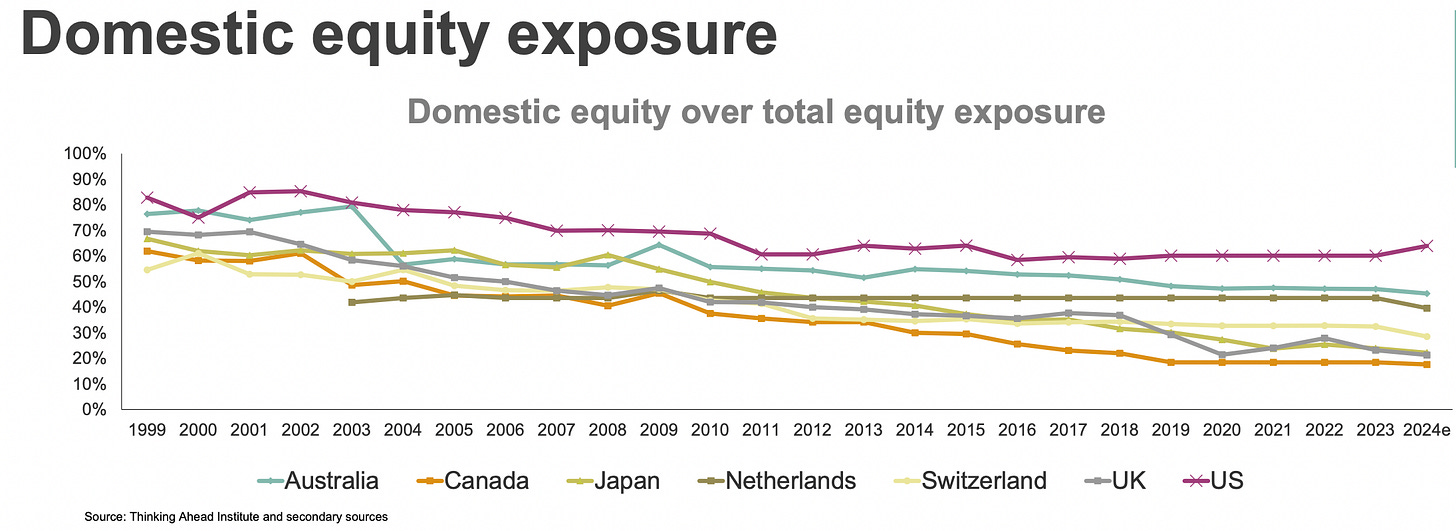

What started out as cyclical swings in risk appetite and bouts of synchronised global growth driving opportunistic allocations eventually became structural. This was most evident in the steady march higher of Int’l weights in popular benchmarks. The market traded each annual MSCI or S&P Int’l index rebalancing event as a catalyst for new flows into the peripheral growth countries. Similarly, as domestic regulators raised Int’l asset allocation ceilings for pension funds, the market positioned for new outflows. These structural outflows were further propelled to new highs by the rise of passive funds management. Forecasting cross-border capital flows became part cyclical/opportunistic, part structural, but while globalisation was in an upswing, the direction of capital outflows - and the benchmarks used to attribute them - were pointing in the same direction.

With this fundamental fact pretty well understood by the market now, most should agree that ‘peak globalisation’ must mark a point where this three-decade trend in structural capital market outflow plateaus and eventually rolls over. The question is, have we arrived at that point?