Why USDJPY intervention makes sense

Keep cap on USDJPY, give the BoJ more time, US SWF can use Yen

Interest rates or currency?

If the US were to ask Japan to choose between lower interest rates or a lower currency, which would Japan choose? That’s the essential question, because having both is no longer constructive for either country.

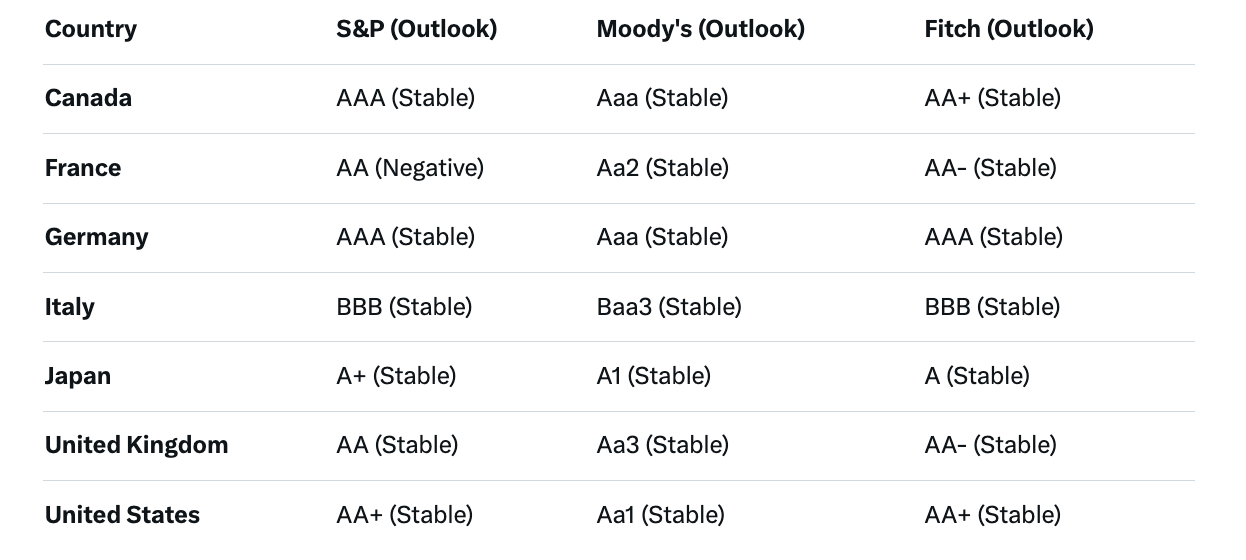

From the Cabinet Office the choice would be clear, as debt servicing has now risen to 9% of the FY25 budget, and set to reach 12-14% by FY28. Recall that Moody’s downgraded the US from Aaa to Aa1 in May this year with debt servicing at 10% of its fiscal budget. Percent of revenues are 14% (Japan) to 18% (US), by comparison.

Japan already has the lowest sovereign rating amongst the G5/G7 (excluding Italy) and it has yet to normalise official rates since the 2022/23 global inflation shock that pressured all the other sovereigns.